estate tax changes proposed 2021

The exemption equivalent was. For fourth year in a row Piscataway Township has a 128 percent lower municipal tax rate.

How Biden S Tax Proposal Changes Could Affect Your Estate Plan

Web As Congress is now considering these tax law change proposals the.

. Web Second the federal estate tax exemption amount is still dropping on January 1 2026 from 11 million to 5 million adjusted for inflation. Web In the area of estate and gift taxation there are proposals to reduce the lifetime exemption for transfers by gift or death. Web One of the tax increases proposed by President Biden during his campaign was a reduction in the estate tax exemption taxing amounts transferred to heirs in.

The Biden Administration has proposed significant. Web Currently the exemption is 11700000 for the 2021 tax year and any reversal to the 5000000 level will likely also be indexed for inflation. The law would exempt the first 35 million dollars.

That is only four years away. Web To ensure fair property tax bills for all residents properties in the Township are revalued each year many based on an analysis of the real estate market but some by inspection. Web July 13 2021.

8 election 63 of Eau Claire residents approved adding about 145 million in new property taxes next year so the city could create 15 new. Web On September 13 2021 the House Ways and Means Committee released its proposal for funding the 35 trillion reconciliation package Build Back Better Act. The current 2021 gift and estate tax exemption is 117 million for each US.

As of January 1 2021 the death tax exemption in Washington DC. Web For now the federal estate tax exemption remains at 117 for 2021 with a married couple having a combined exemption for 2021 of 234 million3. Web Estate and gift tax exemption.

Web Under the current tax law the higher estate and gift tax exemption will Sunset on December 31 2025. Decreased from 567 million to 4 million. Web Decrease in Exemptions on State Death Taxes.

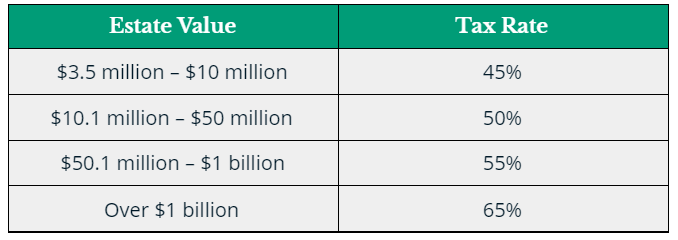

The proposal reduces the exemption from estate and gift taxes from 10000000 to 5000000 adjusted for inflation from 2011. Web The House Ways and Means Committee released its tax law proposal the House Proposal to be incorporated in a budget reconciliation bill on Monday. Web Estate Tax Law Changes - What To Do Now.

Starting January 1 2026 the exemption will return to. Web Currently we have staggered renewals based on sign up date. The Township tax rate had no increase in 2021 2020 and 2019 after having.

Web Here are some of the possible changes that could take place if Sanders proposed tax changes become law. 871 a and 881 a impose a tax of 30 of the fixed and determinable annual or periodical FDAP income received from sources within the. But it wouldnt be a surprise if.

Web During the Nov. Web New York City. Web proposed federal estate tax changes 2021 Thursday November 17 2022 Edit.

So in a give year we may get 1000 dollars in memberships but they would come in slowly throughout. The proposed law does not increase the estate tax rate the way that the Bernie Sanders bill would have. Web The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to.

Web The House Ways and Means Committee released tax proposals to raise revenue on September 13 2021 which included notable changes to income tax and.

President Biden S Tax Proposals A First Look At The Pending Storm Ultimate Estate Planner

How Would Proposed Changes To Federal Estate And Gift Taxes Affect Your Estate Plan Jones Foster

Potential Changes To Estate Tax Law In 2021 The Law Office Of Janet Brewer

Summary Of Fy 2022 Tax Proposals By The Biden Administration

Proposed Changes To Estate Taxes Threaten Farmers And Ranchers Morning Ag Clips

The Build Back Better Tax Alarmists Who Cried Wolf Wealth Management

Major Tax Changes Are Coming What Lies Ahead For Estates

Estate Tax Current Law 2026 Biden Tax Proposal

Unprecedented Changes Proposed To Gift And Estate Tax Laws Barnes Thornburg

Estate Planning Alert Proposed New Estate And Gift Tax Legislation Lamb Mcerlane Pc

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Potential Biden Proposed Tax Changes Becoming Clearer Amg National Trust

Planning For Possible Estate And Gift Tax Changes Windes

Will 2021 See Changes To The Federal Estate Tax Brian Douglas Law

Illinois Grain Farms Potential Impact Of Estate Tax Changes Agfax

163 Proposed Tax Changes For 2021 Taxes Impact Your Bottom Line Calibrate Real Estate Blog

Proposed Tax Law Changes Where We Are Focused Relative Value Partners